Why California Solar Incentives Are More Important Than Ever

California solar incentives are crucial for homeowners facing some of the nation’s highest electricity rates – with costs reaching over $0.32 per kWh and climbing 4.1% annually. While California has long been America’s solar leader with over 49,000 megawatts of installed capacity, recent policy changes like NEM 3.0 have shifted the landscape, making it essential to understand available savings opportunities.

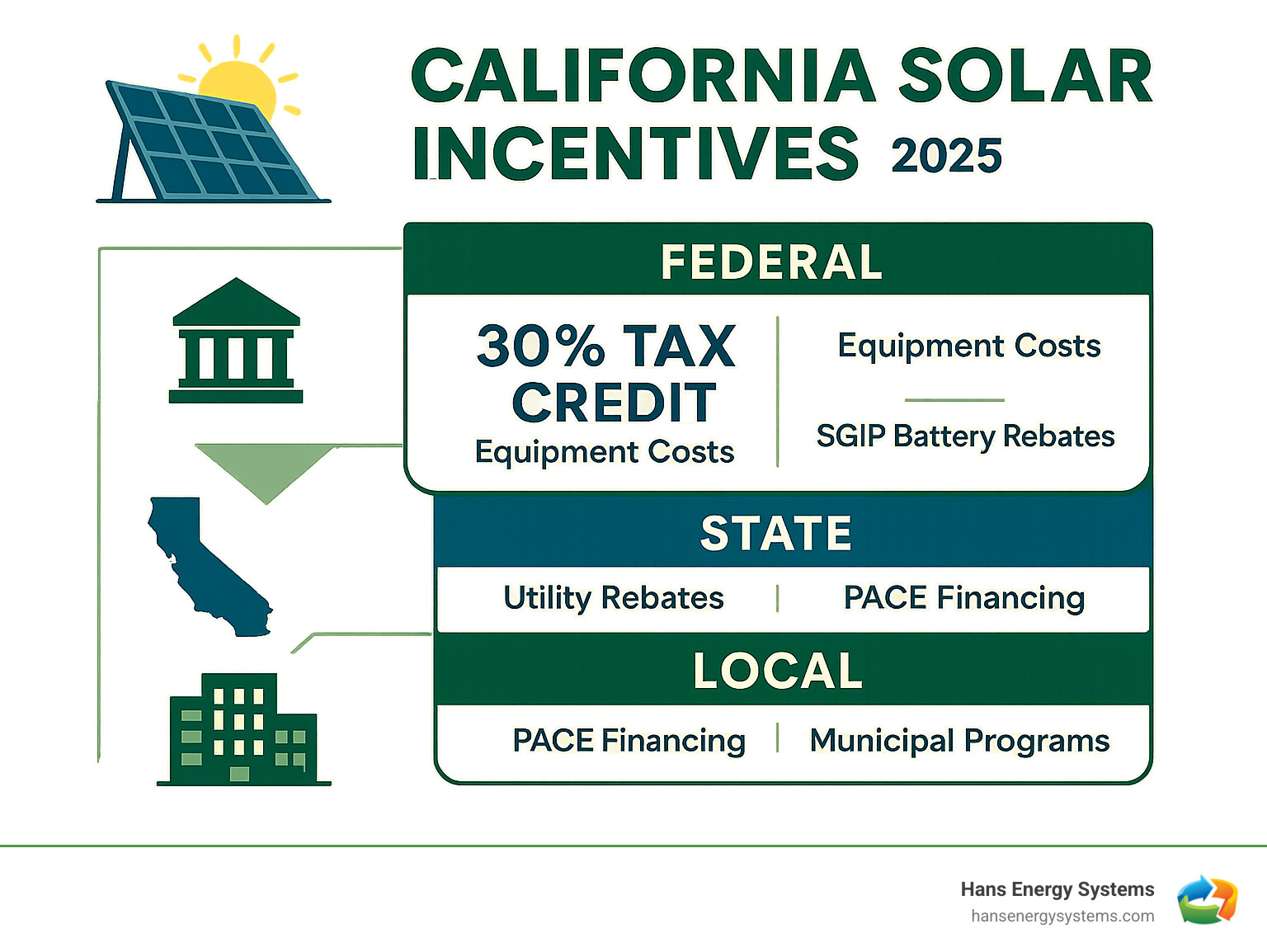

Here are the main California solar incentives available in 2025:

- Federal Solar Tax Credit (ITC): 30% of total system costs through 2032

- California Property Tax Exclusion: No increased property taxes from solar installation (expires Jan 1, 2027)

- Self-Generation Incentive Program (SGIP): Up to $1,000/kWh rebate for battery storage systems

- DAC-SASH Program: Up to $3/watt ($15,000 max) for low-income households in disadvantaged communities

- Local Utility Rebates: Varies by city and utility provider

- Net Billing (NEM 3.0): Credits for excess solar energy sent to the grid

The federal tax credit alone can save homeowners thousands of dollars, while combining multiple incentives can reduce total system costs by $6,700 to $8,800 on average. With California’s transition to Net Billing reducing export credit values by about 75%, pairing solar with battery storage has become more valuable than ever for maximizing savings.

Despite policy changes, solar remains financially attractive in California due to high electricity rates and generous incentive programs – especially when you know how to leverage them effectively.

The Federal Solar Tax Credit: Your Biggest Savings Opportunity

When it comes to California solar incentives, there’s one that towers above all the rest: the federal solar tax credit. Officially called the Residential Clean Energy Credit, this powerhouse incentive is available nationwide and represents your single biggest opportunity to slash the cost of going solar.

Here’s the beautiful part: you can claim 30% of your entire solar system cost as a direct tax credit. We’re not talking about a deduction that might save you a few hundred dollars – this is a dollar-for-dollar reduction in what you owe Uncle Sam. If your system costs $30,000, you’re looking at a $9,000 credit. That’s real money back in your pocket.

Thanks to the Inflation Reduction Act passed in 2022, this generous 30% rate is locked in through 2032. You’ve got plenty of time to make your solar dreams a reality. After 2032, the credit will step down to 26% in 2033, then 22% in 2034, before disappearing entirely unless Congress decides to extend it again.

What counts toward this credit? Pretty much everything that makes your solar system work. The solar panels, inverters, mounting equipment, and all the labor costs for professional installation are covered. Permitting fees and even sales tax count too.

And here’s something many people don’t realize: if you add a Powerwall or other battery storage system that gets charged by your solar panels, that’s eligible for the credit too. With California’s new NEM 3.0 rules making battery storage more valuable than ever, this can add up to significant additional savings.

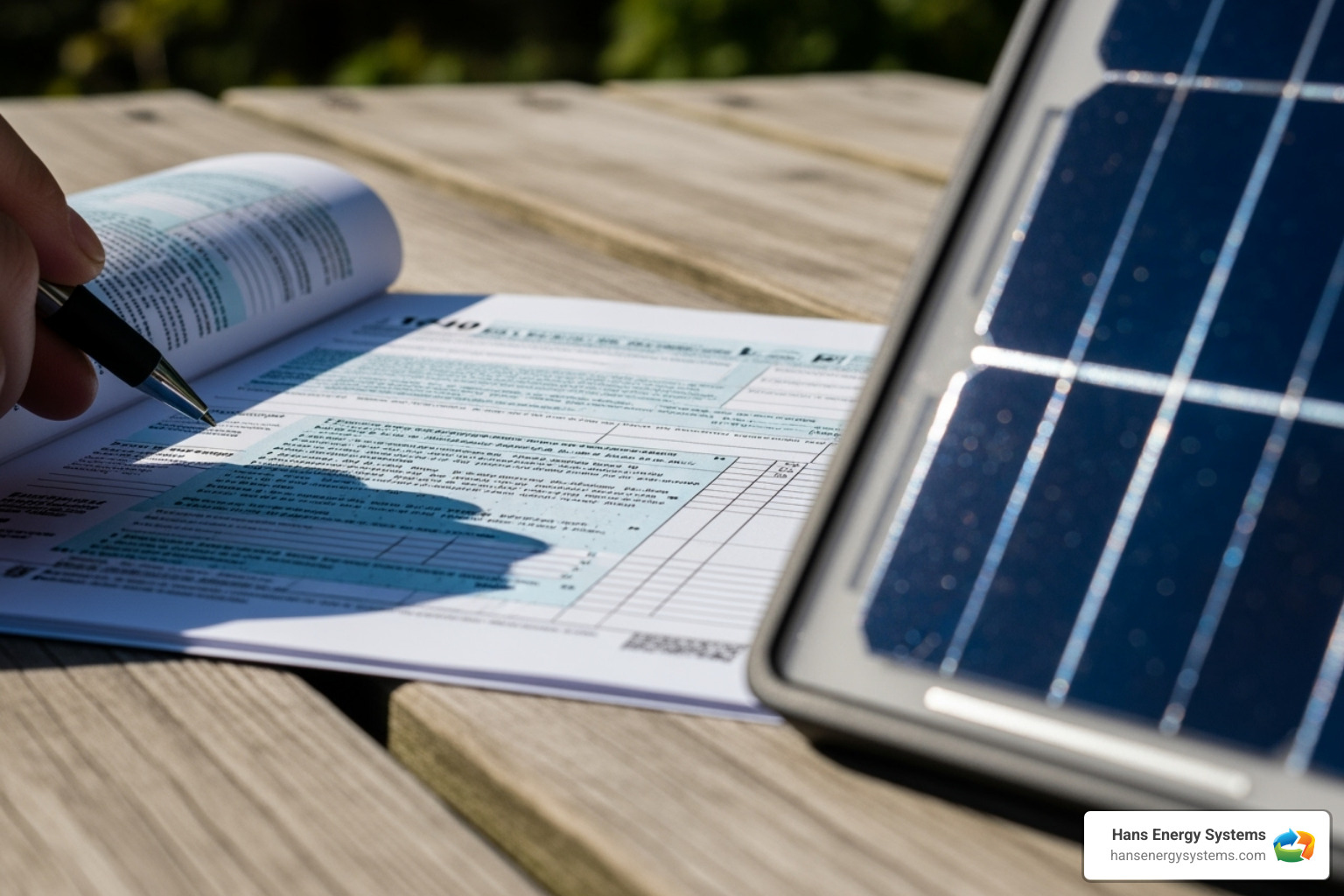

Claiming your credit is straightforward. You’ll fill out IRS Form 5695 when you file your taxes for the year your system goes online. This is what’s called a non-refundable credit, which means it can reduce your tax liability all the way down to zero, but won’t create a refund beyond that.

Don’t worry if your tax bill isn’t big enough to use the entire credit in one year. Any unused portion can roll over to future tax years, so you won’t lose out on those savings. This flexibility makes the credit work for homeowners in all kinds of tax situations.

This federal incentive truly forms the foundation of your solar savings strategy. Combined with California’s state and local programs, it makes going solar one of the smartest financial moves you can make for your home.

Open uping Statewide California Solar Incentives

The federal tax credit is just the beginning of your solar savings story. California has its own treasure trove of incentives that can make going solar even more attractive. With NEM 3.0 changing the game, understanding these state-level programs – especially the importance of energy storage solutions – has become absolutely essential for maximizing your California solar incentives.

Think of it this way: while the federal government gives you the biggest upfront discount, California helps you save money year after year while adding real value to your home. Let’s explore how these programs work together to create serious savings.

Property Tax Exclusion: Add Value, Not Taxes

Here’s something that might surprise you: when you install solar panels on your California home, you won’t pay a penny more in property taxes. This gem of the California solar incentives world is called the Active Solar Energy System Exclusion, and it’s one of those “too good to be true” benefits that actually is true.

Normally, when you make major improvements to your home – think new kitchen, swimming pool, or room addition – your property gets reassessed and your tax bill goes up. But solar panels? They’re completely exempt from this reassessment process.

This means you get to enjoy all the perks of solar without any of the tax penalties. Your home’s value could increase by thousands of dollars (studies suggest solar adds about 4% to home values), but your property tax bill stays exactly the same. It’s like getting a free upgrade that keeps paying you back through lower electricity bills.

The exclusion is currently available for systems installed before January 1, 2027, so there’s still time to take advantage. You can find all the nitty-gritty details about the Active Solar Energy System Exclusion on the state’s official website.

NEM 3.0 (Net Billing): How It Affects Your Solar Savings

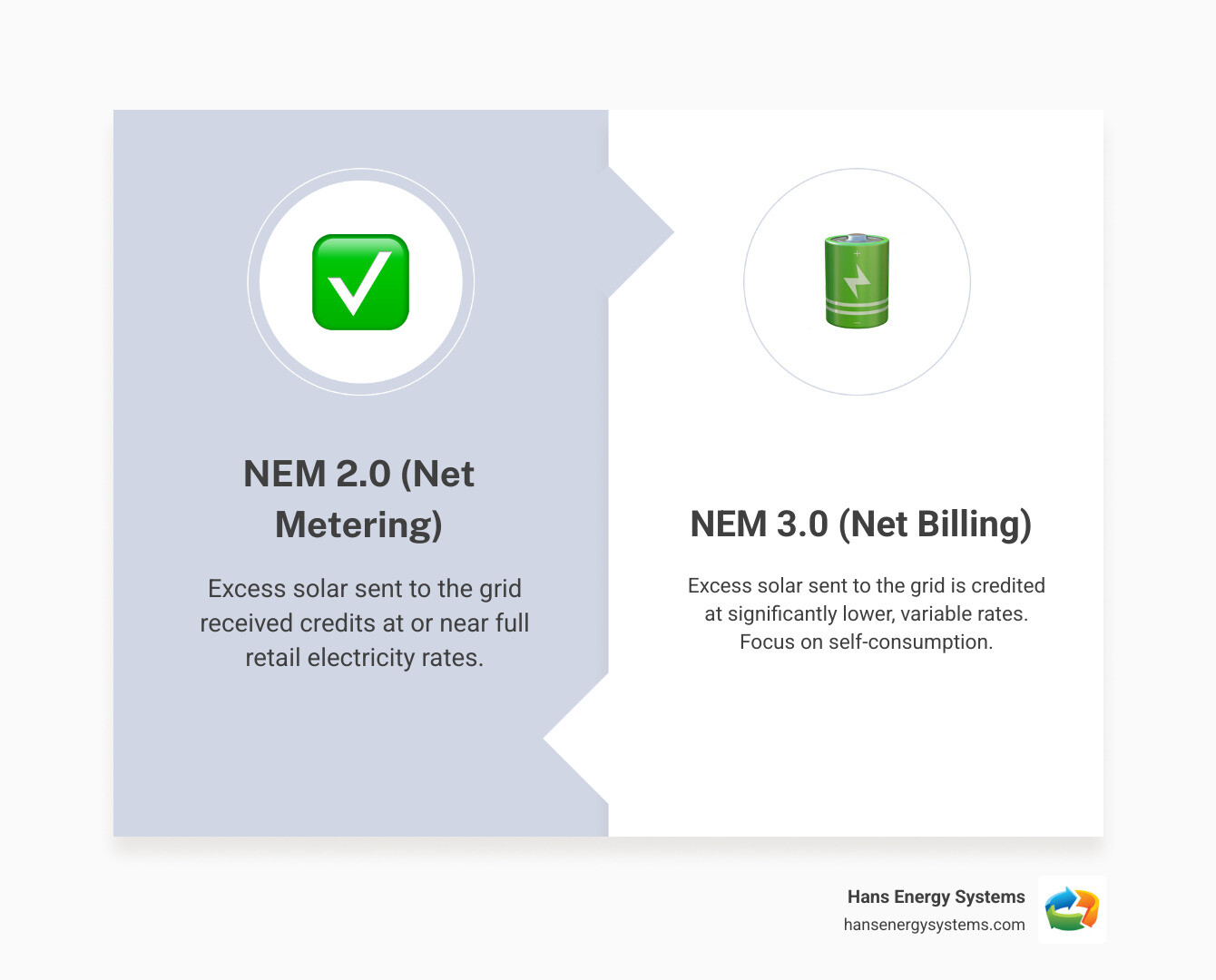

Let’s talk about the elephant in the room: NEM 3.0, also known as Net Billing. If you’ve been researching solar in California, you’ve probably heard mixed things about this policy change. The truth is, while it’s different from the old days, it’s not the solar killer some people make it out to be.

Under the previous Net Metering system (NEM 2.0), excess electricity from your solar panels was credited at nearly the full retail rate. It was an incredibly generous deal that made solar a no-brainer investment.

With NEM 3.0, the game has changed. The export credit rates for sending excess power back to the grid are now significantly lower – about 75% less than they used to be. These rates also fluctuate throughout the day based on grid demand and time-of-use (TOU) schedules.

But here’s the thing: California solar incentives still make sense because our electricity rates are among the highest in the nation and keep climbing. The key now is maximizing self-consumption – using the power your panels generate right when they’re generating it, or storing it for later use.

This shift makes pairing your solar system with battery backup systems more valuable than ever. Instead of sending excess power to the grid for lower credits, you can store that energy and use it during expensive peak hours when grid electricity costs the most. It’s like having your own personal power bank that saves you money every single day.

Yes, the payback period is longer now – we’re talking 10-15 years instead of the 5-6 years we saw with NEM 2.0. But with California’s relentlessly high electricity rates and the long lifespan of solar systems (25+ years), the investment still makes solid financial sense.

Key California Solar Incentives for Battery Storage

Since battery storage has become so important under NEM 3.0, California created a fantastic incentive program specifically for energy storage: the Self-Generation Incentive Program (SGIP). This is where things get really exciting for homeowners looking to maximize their solar investment.

The SGIP provides cash rebates based on how much battery storage capacity you install, measured in kilowatt-hours (kWh). While the base residential rebate might be around $150 per kWh, the program uses a tiered structure that rewards early adopters with higher incentives. As more people participate and budgets get used up, the rebate amounts decrease – so there’s a real advantage to acting sooner rather than later.

What makes SGIP even more compelling are the Equity and Equity Resiliency rebates. These significantly higher incentives are available for specific groups who need energy resilience the most: low-income households, residents of high-fire-threat areas, communities affected by Public Safety Power Shutoffs, and medically vulnerable customers. For these customers, the rebates can be substantial enough to cover a major portion of the battery system cost.

The program is available to customers of California’s major investor-owned utilities: PG&E, SCE, and SDG&E. The application process can be complex, but that’s where working with experienced professionals makes all the difference. We help you steer the eligibility requirements and handle the paperwork so you can focus on enjoying your new energy independence.

That SGIP funding is limited and allocated on a first-come, first-served basis. You can always check the SGIP program’s current status to see current incentive levels and remaining funds, but don’t wait too long – these programs have a habit of getting more popular (and less generous) over time.

Special Programs and Local Rebates

While federal and statewide California solar incentives form the backbone of solar savings, we understand that every homeowner’s situation is unique. That’s why California has created a rich mix of special programs and local rebates designed to provide targeted financial assistance, utility-specific offers, and alternative financing methods. The key is knowing where to look and how these programs can work for your specific circumstances.

Low-Income and Disadvantaged Community Programs

California has made a strong commitment to ensuring that the benefits of solar energy reach everyone, regardless of income level. The Disadvantaged Communities – Single-Family Solar Homes (DAC-SASH) program stands as a powerful example of this commitment, offering life-changing opportunities for eligible families.

This program provides substantial upfront rebates to low-income households in disadvantaged neighborhoods who install rooftop solar systems. To qualify for DAC-SASH, you’ll need to meet specific income requirements that typically align with CARE (California Alternate Rates for Energy) or FERA (Family Electric Rate Assistance) income guidelines. Your home must also be located in a designated disadvantaged community, which you can verify using CalEnviroScreen maps.

The financial impact is remarkable. The program offers approximately $3 per watt for systems up to 5 kilowatts, which can amount to up to $15,000 in direct rebates. For many eligible households, this substantial incentive can lead to a near no-cost solar installation, dramatically changing both their monthly energy bills and environmental impact. It’s truly one of the most generous California solar incentives available.

Finding Local California solar incentives and Rebates

Beyond the major state and federal programs, cities and local utility companies across California offer their own unique incentives and rebates. These programs can vary dramatically from one area to another, ranging from direct financial rebates to reduced permitting fees, and they’re often designed to address specific local energy needs or encourage particular types of solar adoption.

The variety of local programs is impressive. Sacramento Municipal Utility District (SMUD) offers battery storage incentives with potential rebates of up to $10,000 for installing multiple batteries, especially if customers allow SMUD to optimize their battery usage year-round. Los Angeles Department of Water and Power (LADWP) takes a unique approach with their Solar Rooftops Program, where they essentially “rent” your rooftop space, installing and maintaining solar panels at no cost while paying homeowners $240 to $600 annually.

In San Diego, the Green Building Incentive Program reduces plan check and building permit fees by 7.5% for projects that include solar installations. Alameda Municipal Power provides a $500 rebate for income-qualified residents, while Silicon Valley Power offers grant money that can potentially cover the entire cost of solar installations for qualifying low-income customers.

These programs change regularly, so we always recommend checking with your specific city or municipal utility company to find what additional California solar incentives might be available in your area. What’s available in one city might be completely different just a few miles away.

Understanding PACE Financing

For homeowners seeking ways to finance their solar panel installation without upfront costs, Property Assessed Clean Energy (PACE) financing presents an alternative option. PACE programs provide financing for energy-efficient and renewable energy upgrades by allowing residents to repay the loan through an assessment added to their property taxes.

The primary advantage of PACE financing is that it typically requires no upfront payment, making solar accessible to homeowners who might not have immediate cash or traditional loan qualifications. Payments are spread out over 10 to 20 years and added to your annual property tax bill, which can make budgeting more predictable.

However, there are important considerations to keep in mind. PACE financing places a lien on your property, similar to a second mortgage. This can complicate selling your home, as the PACE assessment typically transfers to the new owner unless paid off during the sale. Additionally, interest rates for PACE loans can sometimes be higher than traditional solar loans.

California currently has several state-licensed PACE program administrators, but we generally suggest exploring traditional solar loans first. They often offer more favorable terms and fewer potential complications for homeowners. PACE can be a useful tool in specific situations, but it’s worth understanding all your options before making a decision.

Frequently Asked Questions about Solar Incentives

We get lots of great questions from homeowners who are exploring their solar options. Here are the answers to some of the most common questions we hear about California solar incentives and whether solar still makes sense in today’s market.

Is going solar still worth it in California after NEM 3.0?

You bet it is! We understand why homeowners might feel uncertain about this – NEM 3.0 definitely changed the game. But here’s the thing: California’s electricity rates are absolutely brutal, and they’re not getting any friendlier. We’re talking about some of the highest rates in the entire country, and they keep climbing year after year.

The beauty of solar is that it lets you generate your own power and essentially lock in your energy costs. Think of it as protection against those unpredictable utility rate increases that seem to hit every year. Yes, the payback period might stretch out to around 15 years now (compared to the golden days of 5-6 years under the old system), but you’re still looking at significant long-term savings.

The real game-changer is understanding that California solar incentives now reward self-consumption more than ever. This means pairing your solar panels with battery storage isn’t just a nice upgrade anymore – it’s become essential for maximizing your savings. When you store that excess daytime solar energy and use it during expensive evening peak hours, you’re really sticking it to those high utility rates.

Beyond the dollars and cents, there’s something pretty satisfying about reducing your environmental footprint and gaining energy independence. During those unexpected power outages, you’ll be glad you made the switch!

What’s the difference between residential and commercial solar incentives?

While the basic idea is the same – using incentives to make solar more affordable – the specific programs work quite differently for homes versus businesses.

For homeowners like yourself, the star of the show is that 30% Residential Clean Energy Credit we talked about earlier. It’s straightforward and designed specifically for individual households.

Commercial solar installations get to play with a different set of tools. Businesses can still access federal tax credits, but they also get additional perks like accelerated depreciation (called MACRS), which lets them deduct a big chunk of the system cost from their taxable income right away. There are also specialized programs like Net Energy Metering Aggregation (NEMA), which is perfect for businesses that have multiple electric meters and want to use one solar system to cover them all.

Basically, commercial incentives are built for larger-scale projects and reflect how businesses handle finances differently than homeowners. But the core principle remains the same – making solar more accessible and affordable for everyone.

Are there incentives for solar water heating systems?

While solar electric systems get most of the attention (and the biggest California solar incentives), solar water heating systems do exist – they’re just not as common these days, and the incentive landscape is pretty different.

The truth is, incentives for solar water heating are much smaller and less common than what you’ll find for full solar electric systems. California used to have a dedicated program called CSI-Thermal, but that ship has sailed. Nowadays, if you’re lucky enough to find incentives for solar water heating, they’re more likely to come from your local municipal utility company.

Some utilities might offer a modest rebate for installing a qualifying solar water heater or even solar attic fans. But we’re talking about much smaller amounts compared to the substantial rebates and tax credits available for solar electric systems and battery storage. If you’re curious about what might be available in your specific area, we’d recommend checking directly with your local utility provider – they’d have the most up-to-date information on any niche programs they might offer.

Conclusion: Maximize Your Savings and Go Solar

As we wrap up our journey through California solar incentives, it’s clear that the Golden State still offers incredible opportunities for homeowners to harness the power of the sun while saving thousands of dollars. These incentives work together like pieces of a financial puzzle, creating a compelling case for going solar even in the post-NEM 3.0 era.

The federal tax credit remains your biggest ally, offering that substantial 30% reduction in system costs through 2032. Combined with California’s property tax exclusion that protects you from increased taxes on your home’s added value, and the SGIP battery rebates that can put up to $1,000 per kWh back in your pocket, these incentives significantly reduce the upfront investment in solar energy.

Yes, NEM 3.0 has changed the rules of the game. The days of selling excess power back to the grid at full retail rates are behind us. But here’s the thing – this shift has actually made solar systems smarter and more valuable in the long run. By pairing your solar panels with battery storage, you’re not just generating clean energy; you’re creating your own personal power plant that stores sunshine for those expensive evening hours when the grid is most costly.

The beauty of today’s solar landscape is that there’s truly something for everyone. Low-income households can tap into programs like DAC-SASH for potentially no-cost installations. Local communities offer their own unique rebates and programs. And for those who need flexible financing, options like PACE provide pathways to solar ownership without the upfront investment.

We know that sorting through all these California solar incentives can feel overwhelming. That’s exactly why Hans Energy Systems exists – to be your trusted guide through this process. We’ve helped countless San Diego County homeowners steer these programs, design systems that maximize their savings, and ensure they get every dollar of incentive they’re entitled to.

The window for some of these incredible incentives won’t stay open forever. California’s property tax exclusion expires January 1, 2027, and SGIP rebates decrease as more people participate. The time to act is now, while these programs are at their most generous.

Ready to turn your roof into a money-saving, planet-helping powerhouse? We’re here to make it happen. Start your solar journey with a professional installation and let us help you open up every available incentive for maximum savings!